how to put instacart on taxes

All of the batches are similar. For instance if your 100 turned into 10101 but inflation was 5 the following year that 10101 could only purchase 9595 worth of goods or services.

My Quest For Wireless Charging With An Otterbox Ended With Companies Called Youshares And Saneo Wireless Otterbox Charging

Common problems addressed by the customer care unit that answers calls to 1 888-246-7822 include Refund Update Info Track an Order Place an Order Report a Problem and other.

. Grocery delivery service Instacart must pay Washington DC 254 million to settle a 2020 lawsuit that alleged the company failed to pay required sales taxes and misled city consumers about its. On the Instacart platform customers can go to Account Settings and add their EBT SNAP card as a payment method. Tax withholding depends on whether you are classified as an employee or an independent contractor.

This program isnt for low-income people per se. How To Become An Instacart Shopper. Spark delivery drivers can accept tips.

Types of Instacart Shoppers. They arent a reputable business I dont. With Instacart for a total of 6082 they put a hold of 7500 on my credit card which.

Your Instacart Shopper will see your tip before accepting the order and you have up to 24 hours after the order is delivered to alter your tip. If youre looking for tips tricks and news on how to maximize your income while driving for companies like Doordash Uber Lyft Instacart and Postmates weve got you covered. Superior Court of Los Angeles.

This phone number is Instacarts Best Phone Number because 54540 customers like you used this contact information over the last 18 months and gave us feedback. Taxes delivery tips. Taxes delivery tips.

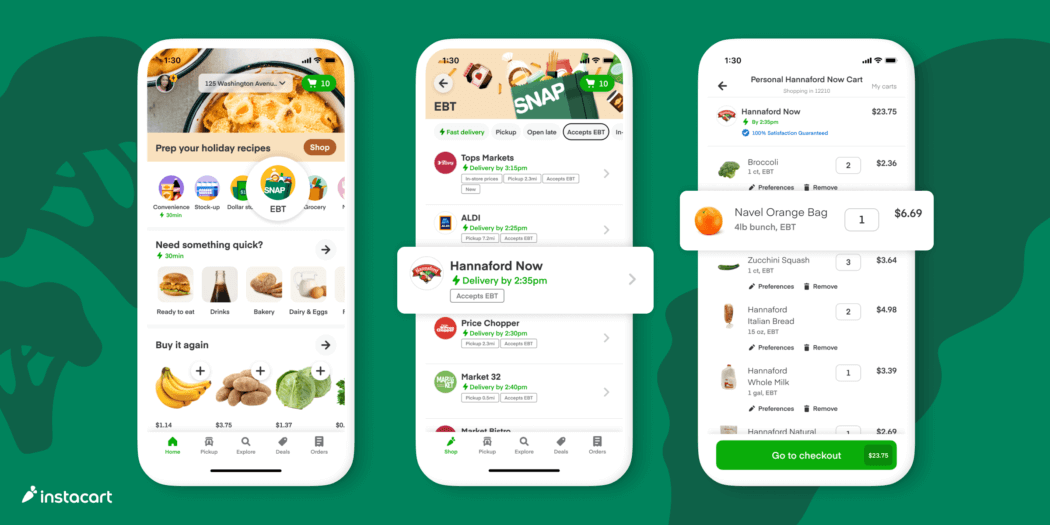

You still put mileage on your vehicle and have to factor in fuel costs and vehicle depreciation. About The Rideshare Guy is the number one destination for gig workers to stay up to date and informed on the gig economy. On the Instacart platform customers can go to Account Settings and add their EBT SNAP card as a payment method.

9 Bills You Should Never Put on Autopay. Ultimately I think becoming an Instacart shopper is a realistic way to make a few hundred dollars per month in extra income. But there are monthly limits on how much income someone can earn from a job.

For Instacart to deliver cigarettes itll have to put in place a mechanism to ensure that these conditions are being met or it may have to face the wrath of the law. Join the 6997 people whove already reviewed Instacart. An example of an Instacart batch.

Customers using the app can select their preferred grocery store put together a shopping list and place an order for delivery. How much difference did daily compounding make. Youll need your 1099 tax form to file your taxes.

So if you paid 75 for your groceries you should at least leave the Instacart shopper a tip of 375. Like rideshare driving Instacart is a flexible way to earn extra money because you can choose your own. It may be in the process of ensuring that these mechanisms are in place or it may have decided that its not worthwhile to deliver tobacco products.

Instacart shoppers are contractors so the company will not deduct taxes from your paycheck. Pay-Per-Trip Incentives Simply put this incentive provides an extra earnings amount upon completion of a single trip. It would barely outpace inflationwhich at a rate of 5 per year would take more purchasing power away than the money youre earning.

Read this first. 9 Bills You Should Never Put on Autopay On the Instacart platform customers can go to Account Settings and add their EBT SNAP card as a payment method. You can save 25 to 30 of every payment and put it in a different account to make saving for taxes easier.

SSDI recipients are also allowed to work and the rules are more lax because they have paid taxes into the system for much longer. They are totally cheeky. Instacart hires in-store shoppers who grab customers items off the shelves and deliver the items off to a persons home.

Grocery delivery service Instacart must pay DC. Your experience can help others make better choices. Additionally you also keep 100 of tips and overall Instacart hourly pay is more volatile than something like delivering for DoorDash since grocery orders can be quite large.

Leaving at least a 5 tip is considered good Instacart tipping etiquette. 1350 a month or 2260 for blind workers as of 2022. Earn an extra 5 for each trip completed after 4pm today.

Instacart is one of the most popular grocery delivery apps and they rely on everyday people like you and me to operate. Plus you must pay the taxes. Common Instacart Shopper Expenses.

Lets look at some common expenses youll have as an Instacart delivery driver. Tax implications as an independent contractor. Instacart an online food delivery service must pay 25 million after the company failed to pay required sales taxes and misled consumers in Washington DC by charging service fees that were.

Because of this the hourly pay you earn from Instacart will not be the final amount you clear after taxes. We break down how Instacart works pros cons pricing and frequently asked questions. Revenue for Instacart during the three months ended in June climbed 39 from the year-earlier period to 621 million investors said the highest quarterly revenue in Instacarts history.

They pay 1371 for 2 different place stores to buy 9 items and delivery them 17 mills. Extra Reading How To Make 50 Per Day. 9 Bills You Should Never Put on Autopay.

Instacart partners with Stripe to file 1099 tax forms that summarize your earnings. Weve put together some FAQs to help you learn more about 1099s and how to use Stripe Express to review your tax information and download your tax forms. IRS deadline to file taxes.

Californias AB5 expanded on a ruling made in a case that reached the California Supreme Court in 2018 Dynamex Operations West Inc. Once the customer places an order an Instacart shopper finds the products that the customer wants purchases them and delivers them to the customers door. 254 million to settle a 2020 lawsuit that alleged the company failed to pay required sales taxes and misled District consumers about its service.

So you might earn 10 to 20 for one batch but get lucky and earn 40 to 50 for another larger batch. This means that you have to cover all your own expenses and pay your own taxes.

8 Of The Best Grocery Delivery Services In 2020

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Unveils New Driver Safety Measures Pymnts Com

1 5 Inch Personalized Custom Doordash Uber Eats Grub Hub Post Mates Instacart Stickers Delivery Driver Bag Sticker For Food Delivery

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart Instacart Rideshare Grubhub

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Expands Ebt Snap Payments Program And Celebrates One Year Of Increasing Access To Food

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

How To Handle Your Instacart 1099 Taxes Like A Pro

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Q A 2020 Taxes Tips And More Youtube

Infographic Holiday Side Hustles Infographicbee Com Holiday Sides Infographic Side Hustle

What You Need To Know About Instacart Taxes Net Pay Advance

How To File Your Taxes As An Instacart Shopper Contact Free Taxes